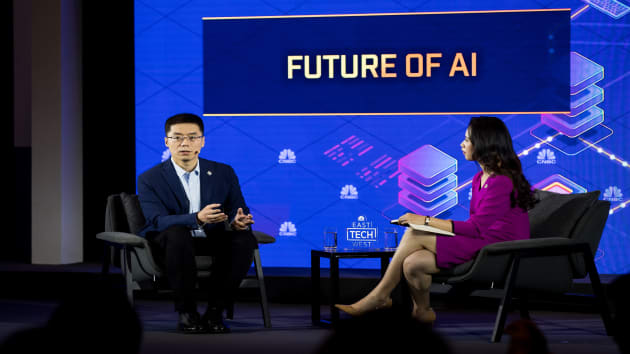

Feng Xingya, President and Executive Director of Guangzhou Automobile Group, speaks at CNBC East Tech West on November 18, 2019 in Nansha, Guangzhou, China.

Zhong Zhi | Getty Images News | Getty Images

NANSHA, China — As trade tensions between China and the U.S. ramp up, many Chinese companies — once with ambitious plans to expand into the U.S. market — have been quietly scaling back.

Still, that’s not holding back some businesses, and many Chinese companies have announced partnerships in Southeast Asia, Europe, and even the Middle East.

One example is Guangzhou Automobile Group — one of China’s largest carmakers.

GAC has set its eyes on the U.S. market since 2018. The company set up research and development centers in Silicon Valley, Los Angles and Detroit, registered its North American sales operations in Irvine this year and showcased at the North American International Auto Show in Detroit to promote its new models.

Everything seemed ready — until the U.S.-China trade war intensified.

“Our initial plan to enter the U.S. market in early 2020 is no longer valid as the U.S. imposed tariffs towards China’s finished automobile exports,” said Feng Xingya, president of GAC Group, during CNBC’s East Tech West conference in the Nansha district of Guangzhou city, China.

The two countries have been imposing punitive tariffs on each other’s goods worth hundreds of billions of dollars. On May 10, the U.S. boosted tariffs from 10% to 25% on $200 billion worth of Chinese goods, including vehicle and automotive parts.

Despite multiple high-level negotiations, there has been solid progress. More tariffs have been set in place, and without a breakthrough, additional U.S. duties will be imposed on Chinese goods as soon as Dec. 15.

“We suspended the development of products and slowed down investment in the U.S. since the beginning of this year,” he said in Mandarin, according to CNBC’s translation. “We are waiting for the tariff situation to be better so that we can restart our development there.”

GAC looks to Middle East, Russia

GAC has announced it will postpone its planned U.S. debut. The automaker, headquartered in Guangzhou, China, is not the only Chinese company that has pulled back on its overseas expansion and investments in the U.S.

According to Rhodium Group, Chinese foreign direct investment (FDI) in the U.S. declined to $4.8 billion in 2018 — down 84% from $29 billion in 2017.

However, the U.S.-China trade tension hasn’t stopped the car-maker from seeking a larger global presence.

Planning to tap into the Oman market by the end of this year, GAC has expanded its footprints in nine countries in the Middle East — including Saudi Arabia, the United Arab Emirates, Kuwait and Qatar. It now has 14 sales outlets in the region.

According to Feng, the company has opened a wholly-owned subsidiary in Hong Kong to better manage its international business.

“We will also enter the Russian market by the end of this year,” he told CNBC. “To date, GAC is present in 24 countries globally and we are speeding up to enter other markets.”

Feng also sees the European Union as a primary market for the company’s new energy cars in the future as the company is betting big on smart and electric automobile technologies.

“New energy cars are very popular in Europe and recently we received invitations from many countries that welcome us to develop in Europe,” Feng added. “GAC’s goal is to become a global enterprise.”

WeChat Pay will go ‘wherever is right and open to us’

Chinese payment giant WeChat Pay, with total daily payment transactions exceeding one billion last year, recently opened its platform to international travelers in China for the first time.

The move is seen as a step to raise brand awareness and educate foreign customers about mobile payment, which will ultimately help Tencent-owned WeChat expand overseas.

“Our overseas strategy is to support Chinese tourists’ traveling and spending abroad because they are used to WeChat Pay domestically,” said Greg Geng, Vice President of Tencent’s WeChat Business Group.

According to data reported by China’s Xinhua News Agency, Chinese citizens made nearly 150 million trips overseas in 2018, a 14.7% increase compared to a year ago.

“We want to make the payment experience easier for WeChat’s users, even when they are overseas,” Geng told CNBC.

WeChat Pay can now be accepted for 16 currencies in more than 60 countries. Since 2017, WeChat has worked with Citcon, a cross-border mobile payments company headquartered in Silicon Valley, to bring mobile payment services to North America.

However, compared to its success in Southeast Asian countries like Singapore and Malaysia — where many stores and businesses embrace WeChat Pay to attract Chinese visitors — its usage in the U.S. is still relatively limited.

With U.S. social media companies like Facebook releasing payment systems, there are concerns that expanding WeChat in the U.S. could become more challenging.

But Geng sees the competition in a different way.

“What we are exporting is a payment product and we need a local partner — whether it’s a bank, a financial institution or a third-party platform,” said Geng in Mandarin. “Everyone thought WeChat and Line are competitors, but we are also partnering on the payment.”

Geng said he would not rule out a potential cooperation opportunity in the future with U.S. companies like Facebook. “We will go wherever is right and open to us,” he added.

‘No country boundary for innovation’

Nasdaq-listed iQiyi, a leading video streaming platform often referred to as the “Netflix of China,” announced its first overseas partnership in June 2019. The online entertainment company expanded its footprint to Malaysia by launching a channel with Astro, a Malaysian satellite television provider, to bring video content to the Southeast Asian country.

“We support subtitle choices for multi-languages including Chinese, English, Malay and Thai,” said Wang Xuepu, Vice president of iQiyi, during CNBC’s East Tech West conference. “We hope to work with local production teams and partners to explore more potentials on personalized content.”

“We hope we can share our technologies and high-quality content with our local partners because we believe there’s no country boundary for innovation,” he told CNBC.

Wang’s views were echoed by Zhang Song, managing director of software consultancy ThoughtWorks, who said countries should work together instead of competing in a so-called “technology race.”

“Products coming out from research centers will be delivered to the global market, not only Chinese people but consumers from the U.S. and other countries will benefit (from these products),” said Zhang.

Wang Xuepu, VP of iQIYI speaks with Qian Chen, reporter of CNBC in Nansha, Guangzhou, China.

Zhong Zhi | Getty Images News | Getty Images

However, as the U.S.-China trade war drags on, Chinese tech companies will continue to feel the restrictions.

iFlytek, an artificial intelligence company in China, was added to a U.S. trade blacklist in October 2019, which prevents the company from buying U.S.-made technology.

But the hurdle might not have much impact on iFlytek’s global ambition, according to Doranda Doo, who is senior vice president at the company.

“We have been actively working on overseas strategies in places including the U.S, Japan, Europe and New Zealand,” said Doo. “Our development will not be stopped.”